Transform Your Financial Future & Career

Build your legacy with your personalized financial strategy that is tailored to your uniques goals and circumstances. We will equip you with the knowledge and tools needed to eliminate debt, build savings, and invest wisely.

Benefits for Working With Us:

Clients benefit from a range of resources, including financial planning templates, eBooks, and blog content, designed to enhance their financial literacy and support their journey toward wealth building.

Comprehensive Financial Education

Through the Financial Literacy and Generational Wealth Course, clients gain access to a wealth of knowledge on budgeting, saving, investing, and estate planning, empowering them to make informed financial decisions.

Holistic Approach

Danielle's approach integrates personal finance with career development, ensuring that clients not only achieve financial stability but also advance in their professional lives.

Proven Track Record

ith a successful history of overcoming personal debt and helping others do the same, Danielle brings a wealth of experience and credibility to her coaching, inspiring confidence in her methods.

About the Agency

We Aim To Be The Best Financial and Business Consult in Ohio.

Danielle is a dedicated Financial Strategist based in Ohio, committed to helping individuals and families achieve financial empowerment and build generational wealth. Through her comprehensive Financial Literacy and Generational Wealth Course, she provides personalized strategies and educational resources tailored to each client's unique goals and circumstances.

Financial Solutions

Expertise You Can Trust

20+

Years Experience

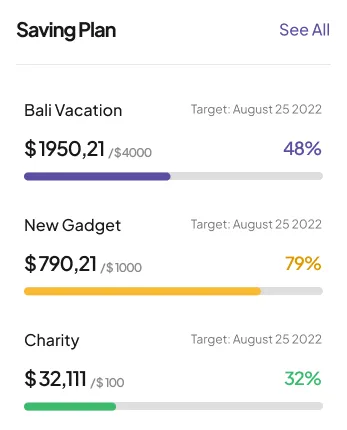

Saving Strategies

Our saving strategies help you grow wealth efficiently and securely.

Unique Strategy

Tailored financial plans that address individual goals and challenges, ensuring a customized approach to achieving financial success.

Ongoing Support and Accountability

Our one-on-one coaching and group sessions, providing continuous support and motivation to help clients stay on track with their financial goals and career aspirations..

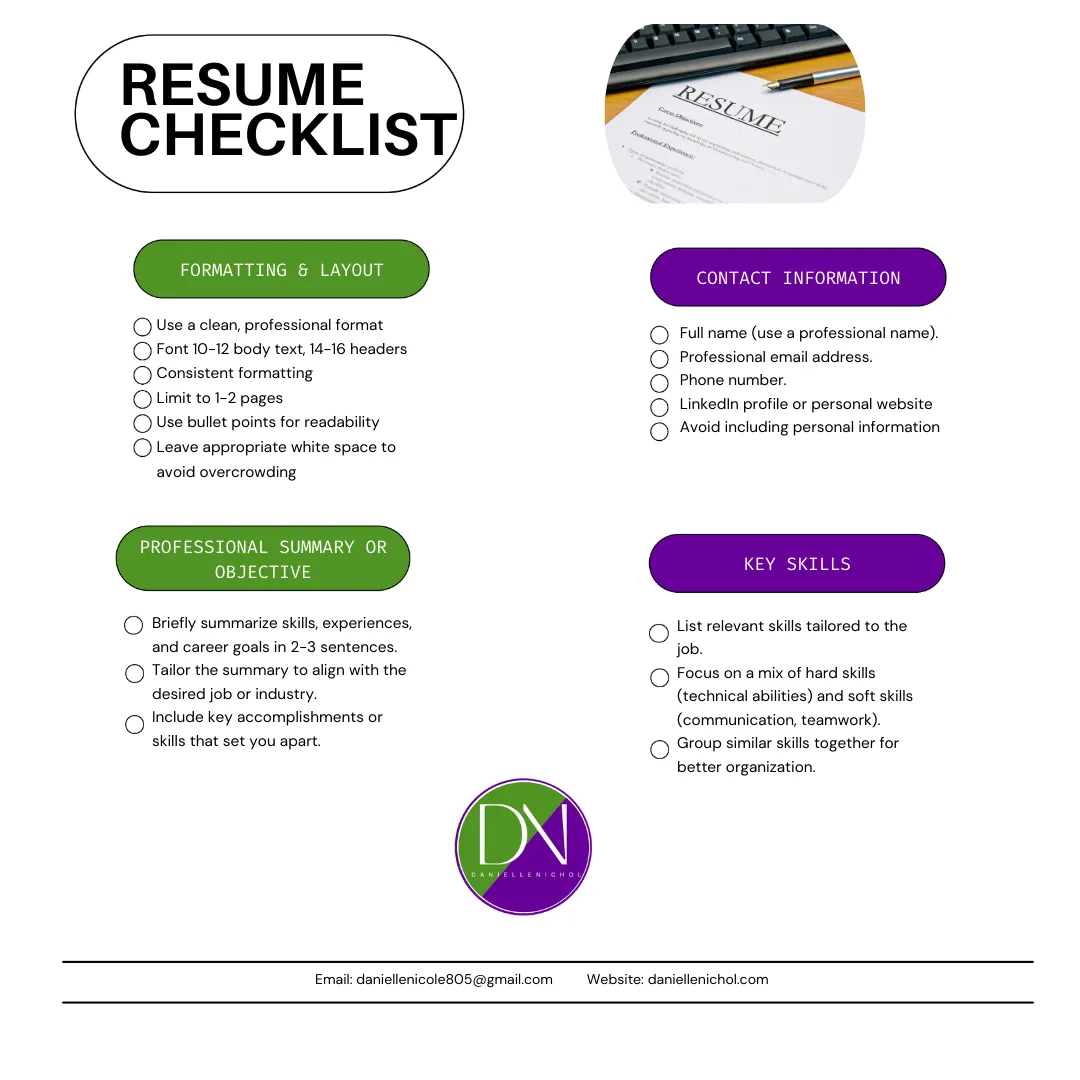

Get Your Free Resource

Level up your career with a free Resume Checklist as a valuable resource for job seekers looking to enhance their professional profiles. This comprehensive checklist is designed to help you ensure that your resume stands out to potential employers by covering all essential elements, from formatting and content to keywords and action verbs. By downloading this free guide, you'll gain access to expert tips and best practices that can significantly improve your chances of landing your dream job. Take the first step towards career success and download your free Resume Checklist today!

What Client Say

Here's what our clients have to say about their experience with our investment services:

The personalized attention and expertise I received helped me achieve financial growth I never thought possible.

James Smith

Office Manager

Working with their team has transformed my financial outlook—they truly understand my goals and needs.

Rachel Lee

Office Manager

Their strategic approach to managing my investments has given me peace of mind and consistent returns.

Michael Chen

Office Manager

Frequently Asked Questions

What is the Financial Literacy and Generational Wealth Course?

The Financial Literacy and Generational Wealth Course is a comprehensive program designed to educate individuals on the fundamentals of personal finance, investing, and building wealth that lasts for generations. The course includes modules on budgeting, saving, investing, business finance, estate planning, and more, providing the tools and knowledge needed to achieve financial empowerment.

Who is this course for?

This course is ideal for anyone looking to improve their financial literacy, eliminate debt, build savings, and invest wisely. Whether you're just starting your financial journey or looking to enhance your existing knowledge, the course offers valuable insights and strategies for individuals at all stages of their financial lives.

How long does the course take to complete?

The course is self-paced, allowing participants to complete it at their own convenience. On average, it takes about 6-8 weeks to complete, depending on the individual's schedule and learning pace. Each module includes video lessons, quizzes, and practical exercises to ensure a thorough understanding of the material.

What support is available during the course?

Danielle and her team offer ongoing support throughout the course, including one-on-one coaching sessions, group discussions, and access to a community of like-minded individuals. Additionally, participants have access to a variety of resources, such as financial planning templates, eBooks, and blog content, to further enhance their learning experience.

Your trusted partner in financial growth and career success, committed to securing your financial future.

Quick Links

Home

About Us

Services

Useful Links

Testimonials

FAQs

Blog